Balance of Trade vs Balance of Payments

What is Balance of Trade (BOT)

In today’s world, all countries import some goods

and services from other countries, and they also export certain other

goods and services which are surplus in their country. The

difference between the value of goods and services exported out of a

country and the value of goods andservices imported into the country.If a

country has a balance of trade deficit, it imports more than it exports, and if

it has a balance of trade surplus, it exports more than it imports.The balance

is said to be favorable when the value of the exports exceeded that

of the imports (i.e.exports exceed imports),

and unfavorable when the value of the imports exceeded that of the

exports (i.e. imports exceed exports).

What are the Factors That Affect Balance of Trade

Factors that can affect the balance of trade include:

i. The cost of production (land, labour, capital, taxes,

incentives, etc.) in the exporting economy vis-à-vis those in

the importing economy

ii. The cost and availability of raw materials, intermediate goods

and other inputs

iii. Exchange rate movements

iv. Multilateral, bilateral and unilateral taxes or restrictions

on trade

v. Non-tariff barriers such as environmental, health or safety

standards

vi. The availability of adequate foreign exchange with which to

pay for imports; and

vii. Prices of goods manufactured at home (influenced by the

responsiveness of supply)

Difficulties in Measuring Balance of Trade

Sometimes it is difficult to measure accurately the ‘Balance of

Trade’ because of problems with recording and collecting data. One interesting

example is the problem faced when official data for all the world's countries

are added up. It is reported that in such a case, exports exceed imports by

almost 1%. The question which baffles is as to why this difference? Normally,

both these should match. However, it appears that the world is running a

positive balance of trade with itself. This cannot be true, because all

transactions involve an equal credit or debit in the account of each nation.

The discrepancy is widely believed to be explained by transactions intended to

launder money or evade taxes, smuggling and other visibility problems. However,

especially for developed countries, accuracy is likely.

What is Balance of Payment

Balance of Payment is a system of recording all the economic

transactions of a country, with the rest of the world over a period, say one

year.

Typically, the transanctions included in BoP are country's exports

and imports of goods, services, financial capital, and financial

transfers. Thus, in nut shell we can say, the BoP accounts

summarize international transactions for a specific period, usually a year, and

are prepared in a single currency, typically the domestic currency for the

country concerned.

To understand the same better, we can conclude :

The balance of payments (BOP) is an accounting of a country's

international transactions for a particular time period. Any transaction that causes money to flow into a

country is a credit to its BOP account, and any transaction that causes money

to flow out is a debit. The BOP

includes the current account, which mainly measures the flows of goods and services;

the capital account, which consists of capital transfers and the acquisition

and disposal of non-produced, non-financial assets; and the financial account,

which records investment flows.The BOT is typically the biggest bulk of

a country's balance of payments as it makes up total imports and exports.

BOP is said to be favorable balance of payments, when more

payments are coming in than going out, and will be unfavourable when less

payments are coming in than what is going out.

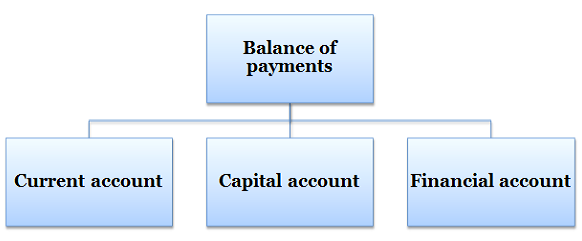

The Balance of Payments Divided:The BOP is divided into three main categories:

(a) the current account

(b) the capital account and

(c) financial account.

Within these three categories are sub-divisions, each of which accounts for a different type of international monetary transaction.

(b) the capital account and

(c) financial account.

Within these three categories are sub-divisions, each of which accounts for a different type of international monetary transaction.

The

Current Account

The current account is used to mark the inflow and outflow of goods and services into a country. Earnings on investments, both public and private, are also put into the current account.

The current account is used to mark the inflow and outflow of goods and services into a country. Earnings on investments, both public and private, are also put into the current account.

Within

the current account are credits and debits on the trade of merchandise, which

includes goods such as raw materials and manufactured goods that are bought,

sold or given away (possibly in the form of aid). Services refer to receipts

from tourism, transportation (like the levy that must be paid in Egypt when a

ship passes through the Suez Canal), engineering, business service fees (from

lawyers or management consulting, for example) and royalties from patents and copyrights.

When combined, goods and services together make up a country's balance of trade (BOT).

The BOT is typically the biggest bulk of a country's balance of payments as it

makes up total imports and exports. If a country has a balance of trade

deficit, it imports more than it exports, and if it has a balance of trade

surplus, it exports more than it imports.

Receipts

from income-generating assets such as stocks (in the form of dividends) are

also recorded in the current account. The last component of the current account

is unilateral

transfers. These are credits that are mostly worker's remittances,

which are salaries sent back into the home country of a national working

abroad, as well as foreign aid that is directly received.

The

Capital Account

The capital account is where all international capital transfers are recorded. This refers to the acquisition or disposal of non-financial assets (for example, a physical asset such as land) and non-produced assets, which are needed for production but have not been produced, like a mine used for the extraction of diamonds.

The capital account is where all international capital transfers are recorded. This refers to the acquisition or disposal of non-financial assets (for example, a physical asset such as land) and non-produced assets, which are needed for production but have not been produced, like a mine used for the extraction of diamonds.

The capital account

is broken down into the monetary flows branching from debt

forgiveness, the transfer of goods, and financial assets by migrants leaving or

entering a country, the transfer of ownership on fixed assets (assets such as

equipment used in the production process to generate income), the transfer of

funds received to the sale or acquisition of fixed assets, gift and inheritance

taxes, death levies and, finally, uninsured damage to fixed assets.

The

Financial Account

In the financial account, international monetary flows related to investment in business, real estate, bonds and stocks are documented. Also included are government-owned assets such as foreign reserves, gold, special drawing rights(SDRs) held with the International Monetary Fund (IMF), private assets held abroad and direct foreign investment. Assets owned by foreigners, private and official, are also recorded in the financial account.

In the financial account, international monetary flows related to investment in business, real estate, bonds and stocks are documented. Also included are government-owned assets such as foreign reserves, gold, special drawing rights(SDRs) held with the International Monetary Fund (IMF), private assets held abroad and direct foreign investment. Assets owned by foreigners, private and official, are also recorded in the financial account.

BALANCE OF TRADE VS

BALANCE OF PAYMENT OR BOT VS BOP

(What is the difference

between Balance of Payment and Balance of Trade)

Basis of Difference

|

Balance of Trade (BOT)

|

Balance of Payment (BOP)

|

1. Definition

|

Balance of Trade is defined as 'difference between export and import of goods andservices'

|

Balance of Payment is defined as the 'flow of cash between domestic country and all other foreign countries'. It includes not only import and export of goods and services but also includes financial capital transfer.

|

2. How Is It Calculated?

|

BOT = Net Earning on Exports - Net payment made for imports

|

BOP = BOT + (Net Earning on foreign investment i.e. payments made to foreign investors) + Cash Transfer + Capital Account +or - Balancing Item

or BOP = Current Account + Capital Account + or - Balancing item ( Errors and omissions) |

3. When is it considered as Favourable or

Unfavourable? |

If export is more than

import, at that time, BOT will be favourable. If import is more than export, at that time, BOT will be unfavourable. |

Balance of Payment will be favourable, if the country has surplus in current account for paying your all past loans in her capital account.

Balance of payment will be unfavourable, if country has current account deficit and it took more loan from foreigners. After this, it has to pay high interest on extra loan and this will make BOPunfavourable. |

4. Solution of being Unfavourable

|

To Buy goods and services

from domestic country. |

To stop taking of loan from foreign countries.

|

5. Factors

|

Following are main factors which affect BOT

a) cost of production b) availability of raw materials c) Exchange rate d) Prices of goods manufactured at home |

Following are main factors which affect BOP

a) Conditions of foreign lenders. b) Economic policy of Govt. c) all the factors of BOT |

Comments

Post a Comment